[ad_1]

Introduction

Candlestick patterns, including the Hanging Man pattern, are a fundamental part of technical analysis, providing valuable insights into market trends, sentiment, and potential reversals. These patterns represent price movements over a specific period and help traders make informed trading decisions. Each candlestick consists of four key data points: open, high, low, and close prices.

Among the many candlestick patterns, the Hanging Man Candlestick Pattern is particularly significant as a bearish reversal signal. It usually appears at the end of an uptrend and suggests that selling pressure is increasing, potentially leading to a price decline. Traders who recognize this pattern can use it as a warning to exit long positions or prepare for short-selling opportunities.

The Hanging Man Pattern is a single-candle formation that signals a shift in market sentiment. However, it should not be traded in isolation. Traders should always look for confirmation signals, such as a subsequent bearish candlestick, increased trading volume, or confluence with other technical indicators like resistance levels and moving averages.

Understanding the significance of the Hanging Man Candlestick Pattern and how to interpret it effectively can improve a trader’s ability to navigate financial markets with confidence.

What is the Hanging Man Candlestick Pattern?

The Hanging Man is a single candlestick pattern that signals a potential reversal in an uptrend. It forms when an asset’s price opens higher, trades significantly lower during the session, but then closes near its opening price. The long lower wick indicates selling pressure, while the small body suggests uncertainty in the market.

Key Features of the Hanging Man Pattern:

- Appears after an uptrend

- Small real body (either bullish or bearish)

- Long lower shadow (at least twice the size of the real body)

- Little to no upper shadow

This pattern suggests that sellers have started gaining control, and a trend reversal could be on the horizon.

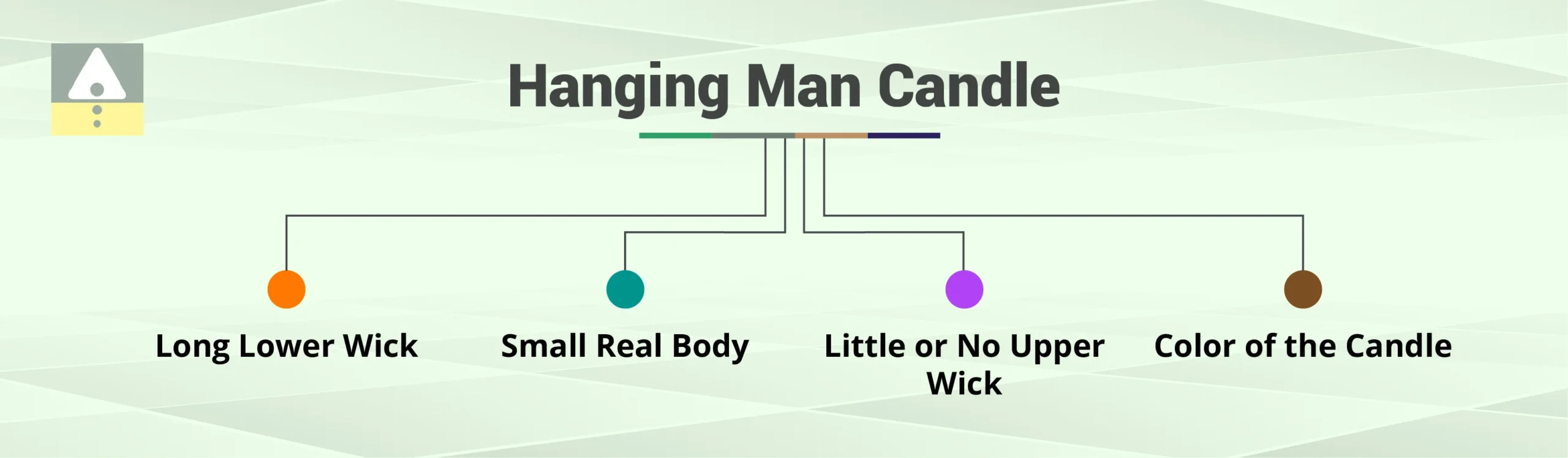

Characteristics of the Hanging Man Candle

The Hanging Man Candle has distinct characteristics that make it easy to identify on a price chart:

- Long Lower Wick: This shows that sellers pushed the price down significantly before buyers attempted to regain control.

- Small Real Body: Represents indecision between buyers and sellers.

- Little or No Upper Wick: Confirms the lack of strong bullish momentum.

- Color of the Candle: While both red (bearish) and green (bullish) candles can form the hanging man pattern, a red candle is considered a stronger bearish signal.

Hammer candlestick pattern

The hammer candlestick pattern is a single candle that forms after a downtrend and signals a potential reversal to the upside. It’s characterized by a small real body (the difference between the open and closed) near the top of the candlestick, with a long lower shadow and little or no upper shadow.

Key Characteristics of the Hammer Candlestick:

- Small Real Body: The body (the area between the open and close) is small, located at the top of the candlestick.

- Long Lower Shadow: The lower shadow should be at least twice the length of the body. This shows that the price dropped significantly during the session, but buyers managed to push it back up before the close.

- Little or No Upper Shadow: The hammer typically has little or no upper shadow, indicating that the price didn’t rise much during the session.

Types of Hammer Candlesticks:

- Bullish Hammer: When the close is above the open, forming a green or white candlestick. This suggests stronger buying pressure after the price drops.

- Bearish Hammer (Red Hammer candlestick): When the close is below the open, forming a red candlestick. It indicates that even though the sellers were in control for much of the session, the buyers regained some control by the end, but with weaker buying momentum.

Significance of the Hammer:

- Location: The hammer is most significant when it appears after a prolonged downtrend, indicating a potential reversal to the upside.

- Psychology: The long lower shadow shows that sellers initially took control, pushing the price lower. However, by the end of the session, buyers fought back and pushed the price higher, signaling a shift in market sentiment.

- Confirmation: A single hammer candlestick alone does not guarantee a reversal. It’s best to look for confirmation from subsequent candles. A strong bullish candle following the hammer would increase the chances of a reversal.

Hanging Man vs. Hammer Candlestick

The Hanging Man and Hammer Candlestick Patterns share visual similarities, but their market implications differ. The term Hanging Man is crucial in differentiating between these patterns, as the Hanging Man appears at the end of an upward trend indicating a potential bearish reversal, while the Hammer signifies bullish potential at a downward trend:

| Feature | Hanging Man | Hammer Candlestick |

| Trend Appearance | Forms after an uptrend | Form after a downtrend |

| Market Signal | Bearish reversal | Bullish reversal |

| Confirmation Needed | Yes, a bearish close after the pattern | Yes, a bullish close after the pattern |

A Bullish Hammer signals a potential upward reversal after a downtrend, while a Hanging Man warns of a downward reversal after an uptrend.

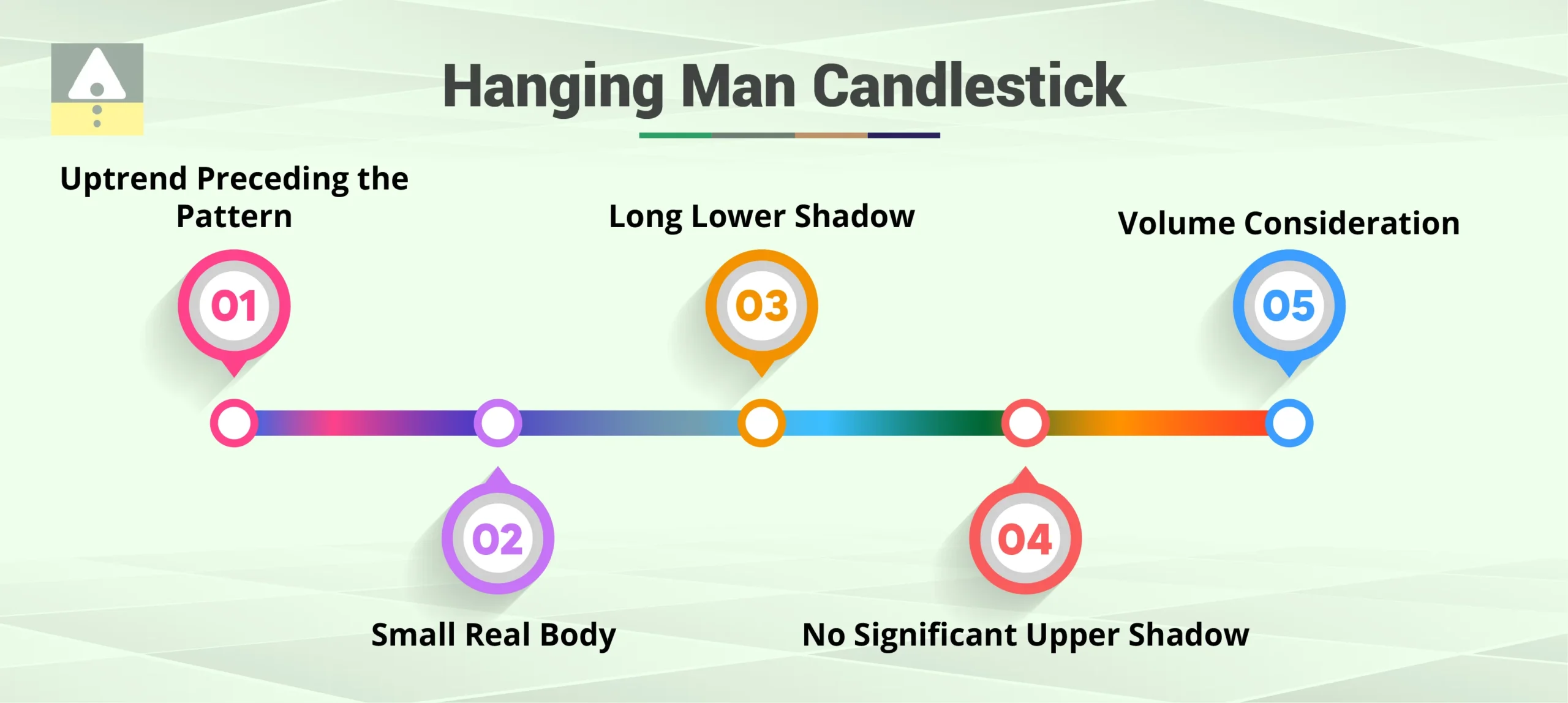

How to Identify the Hanging Man Candlestick Pattern?

To spot the Hanging Man Candlestick, look for the following conditions:

- Uptrend Preceding the Pattern – The pattern should form at the peak of an upward movement.

- Small Real Body – The closing price should be close to the opening price.

- Long Lower Shadow – At least twice the size of the real body.

- No Significant Upper Shadow – Indicates weak buying pressure.

- Volume Consideration – Higher trading volume on the pattern day strengthens its reliability.

Trading Strategies Using the Hanging Man Pattern

Traders use the Hanging Man Candlestick Pattern alongside confirmation signals to make profitable decisions. Below are a few trading strategies:

1. Wait for Confirmation

- The pattern alone does not confirm a reversal. Traders wait for a bearish candlestick on the next trading session to validate the signal.

2. Combine with Technical Indicators

- Relative Strength Index (RSI): If RSI is above 70, it indicates an overbought market, strengthening the bearish signal.

- Moving Averages: A downward crossover in moving averages supports the bearish sentiment.

3. Stop-Loss and Risk Management

- Place a stop-loss above the high of the Hanging Man candle to limit risk.

- Set a profit target based on key support levels or Fibonacci retracement levels.

Practical Applications of the Hanging Man Pattern

The Hanging Man Pattern is a versatile tool that traders can apply across various markets, including the stock market, forex market, and cryptocurrency market. This pattern helps traders identify potential bearish trends in the market, allowing them to make informed investment decisions.

When using the hanging man pattern, traders should keep the following points in mind:

- End of an Uptrend: The pattern typically forms at the end of an uptrend, indicating that prices have reached their peak and a decline may be imminent.

- Visual Appearance: The candlestick resembles a hanging man, signaling a potential bearish trend in the market.

- Complementary Tools: Traders should use other technical analysis tools, such as the RSI indicator, to enhance the accuracy of their investment decisions.

By incorporating the hanging man pattern into their trading strategy, traders can better anticipate market movements and manage their investments more effectively.

Technical Analysis and the Hanging Man Pattern

The Hanging Man Pattern plays a crucial role in technical analysis, as it signals potential bearish trends in the market. This pattern helps traders make informed investment decisions and manage their risk more effectively.

When using the hanging man pattern, traders should also consider the following technical analysis tools:

- RSI Indicator: The Relative Strength Index (RSI) helps traders identify overbought conditions in the market, which can strengthen the bearish signal of the hanging man pattern.

- Moving Averages: Moving averages can indicate potential bearish trends when they show a downward crossover, supporting the signal given by the hanging man pattern.

- Bollinger Bands: These bands help traders identify market volatility and potential reversal points, complementing the hanging man pattern’s bearish signal.

By combining the hanging man pattern with these technical analysis tools, traders can make more accurate investment decisions and better manage their risk. This holistic approach to technical analysis ensures that traders are well-prepared to navigate the complexities of the financial markets.

Hanging Man Candlestick Pattern in Different Markets

The Hanging Man Pattern is applicable across various financial markets:

- Stock Market: Commonly seen in stocks before a downtrend begins.

- Forex Market: Used to analyze currency pairs, especially when combined with fundamental analysis.

- Cryptocurrency Market: Due to volatility, confirmation signals are crucial when trading crypto assets.

Regardless of the market, traders should always seek additional confirmations before making trading decisions.

Common Mistakes While Trading the Hanging Man Pattern

1. Misinterpreting the Pattern

- Traders sometimes confuse the Hanging Man with the Hammer, leading to incorrect trade setups.

2. Ignoring Market Context

- The pattern should only be considered valid if it appears after a strong uptrend.

3. Neglecting Confirmation Signals

- Entering a trade immediately after spotting the pattern without waiting for a bearish confirmation candle increases risk.

Open free demat account in 5 minutes

Conclusion

The Candlestick Pattern Hanging Man is a powerful tool for identifying potential market reversals. However, relying solely on this pattern can lead to false signals. By combining it with other technical indicators and confirmation techniques, traders can improve accuracy and minimize risks.

Understanding candlestick patterns like the Hanging Man helps traders make well-informed decisions, ultimately leading to more effective trading strategies and profitable outcomes.

For expert guidance on market trends and technical analysis, Jainam Broking provides professional insights to help traders navigate financial markets effectively.

So, are you planning on trading in the stock market? If yes, you are at the right place!

Open a Demat Account with Jainam Broking Ltd. Now!

[ad_2]

publish_date]