[ad_1]

Introduction

Equity is one of the most fundamental concepts in the world of investing and corporate finance. Whether you’re a beginner trying to understand what equity is or a seasoned investor aiming to diversify your equity investment portfolio, this guide will give you a comprehensive understanding of the different types of equity shares, their features, and how they fit into the broader types of shares.

What is Equity?

Equity refers to ownership in a company. It represents the amount of capital that would be returned to a company’s shareholders if all the assets were liquidated and all its debts paid off. Equity reflects the company’s financial health by showing the balance between its assets and liabilities. In simpler terms, equity is the value of a shareholder’s stake in a company. Shareholder equity is a crucial financial metric in financial reports, indicating the net worth of a company and the value of an investor’s stake.

What is Share?

A share is a unit of ownership in a company. When you buy a share, you become a partial owner of the company. This means you own a portion of the company’s stock, which can have various implications, including potential dividends and voting rights. The term “equity share” is often used interchangeably with “share” or “stock,” but it specifically refers to ordinary shares that confer ownership rights.

Understanding Equity Shares

What is an Equity Share?

An equity share, also known as an ordinary share, represents a unit of ownership in a company. Equity shareholders have voting rights and a claim on profits in the form of dividends. Additional paid-in capital is a crucial component of shareholder equity, showcasing its role in the overall valuation of a company. Unlike preference shares, equity shareholders do not have a fixed rate of return. Equity capital is significant in the company’s financial structure, as it includes both contributed equity capital from stockholders and retained earnings, which can surpass the initial contributions over time.

Types of Shares in the Market

When discussing ownership in a company, it’s important to understand that not all shares are created equal. Shares can be broadly classified into two primary categories:

- Equity Shares

- Preference Shares

Net asset value is calculated by subtracting liabilities from total assets.

Each of these categories carries different rights, obligations, and risk profiles. Subtracting liabilities is crucial in determining the net asset value of shares.

Equity Shares:

These are the most commonly traded shares in the stock market. Equity shares represent ownership in the company and come with voting rights, a share in profits (dividends), and potential capital appreciation. Equity investors purchase these shares to gain ownership in companies, expecting to profit through dividends or capital gains when the value of their investments rises. It bears more risk compared to preference shareholders, but also has the chance to benefit more when the company performs well. Owning equity aligns the interests of shareholders with the company’s success, providing benefits not just for individual shareholders but also as an incentive for employees.

Preference Shares:

Preference shares, on the other hand, offer a fixed dividend payout and have priority over equity shares during dividend distribution and liquidation. However, they typically do not come with voting rights. These are more suitable for investors seeking stable and predictable returns.

While both types of shares have their place in corporate financing and investment portfolios, this guide will primarily focus on the types of equity, specifically the different types of equity shares that investors commonly encounter. Understanding these distinctions helps investors align their equity investments with financial goals and risk tolerance.

Equity Shares vs. Preference Shares

Equity shares represent ownership in the company and come with voting rights, a share in profits (dividends), and potential capital appreciation. Ownership interest shows the value that belongs to shareholders after the business deducts its liabilities, and it plays a crucial role when businesses seek funding by selling equity without taking on repayment obligations. Equity shareholders bear more risk compared to preference shareholders, but also have the chance to benefit more when the company performs well. Private equity plays a significant role in financing privately held companies through various forms such as venture capital and leveraged buyouts (LBOs).

| Feature | Equity Shares | Preference Shares |

| Voting Rights | Yes | Usually No |

| Dividend | Variable | Fixed |

| Risk | Higher | Lower |

| Priority in Liquidation | After preference shareholders | Before equity shareholders |

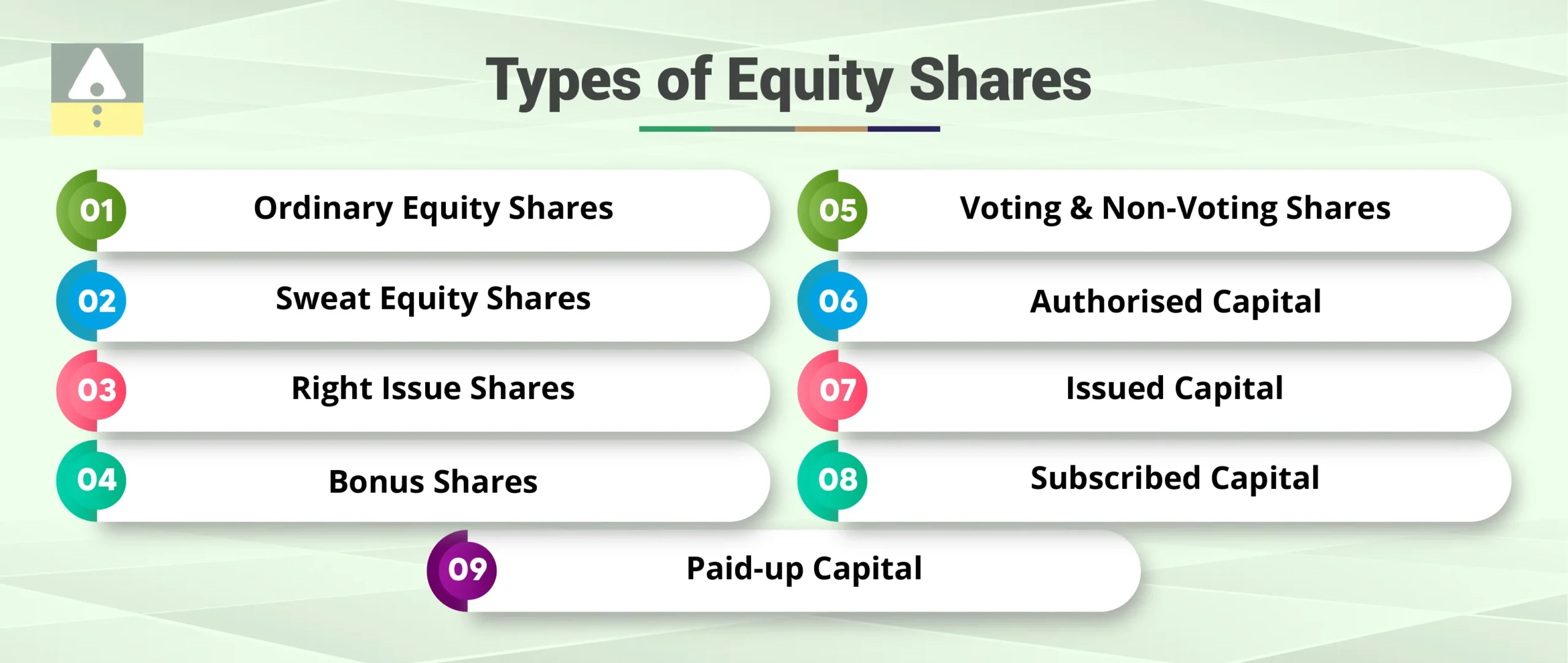

Types of Equity Shares

Understanding the various types of equity shares is essential for making informed investment decisions. Retained earnings play a crucial role in shareholder equity, representing the portion of net earnings not distributed as dividends but saved for future use. Additionally, privately held companies have unique equity structures, involving different mechanisms for valuation and requiring accredited investors. Here are the major types:

1. Ordinary Equity Shares

These are the most commonly issued shares by companies and represent true ownership. Holders of ordinary equity shares enjoy the right to vote in company matters, receive dividends (if declared), and benefit from capital appreciation. The current market value is crucial in determining the worth of equity shares, as it reflects the real-time valuation of the company’s equity. They bear the highest risk but also the potential for the highest reward.

2. Sweat Equity Shares

Companies issue sweat equity shares to employees, directors, or stakeholders who significantly contribute to their growth through skills, time, or expertise. They typically offer these shares at a discount or in exchange for non-cash contributions, using them as an incentive for long-term association with the company.

3. Right Issue Shares

A rights issue is when a company offers new shares to its existing shareholders at a discounted price and in proportion to their current holdings. This enables the company to raise fresh capital while allowing existing shareholders to maintain their percentage ownership, thereby avoiding significant dilution.

4. Bonus Shares

Bonus shares are issued from the company’s accumulated reserves to existing shareholders free of cost. It’s a way to reward loyal shareholders without reducing cash reserves. Although bonus shares don’t add immediate value, they increase the number of shares held and can potentially enhance returns when stock prices rise.

5. Voting and Non-Voting Shares

While most equity shares come with voting rights, some may be structured as non-voting shares. Companies may issue such shares to raise capital while allowing promoters to retain control. Voting shares empower shareholders to influence major decisions; non-voting shares focus more on dividend income and capital gains.

6. Authorised Capital

The company’s Memorandum of Association legally permits it to raise a maximum amount of equity share capital, known as the authorized capital. This capital ceiling represents the limit up to which the company can issue shares, and the shareholders can increase it through their approval.

7. Issued Capital

Out of the authorised capital, the company may decide to offer only a portion to investors. This portion is known as issued capital. It reflects the total value of shares the company has made available to investors for subscription.

8. Subscribed Capital

From the issued capital, the portion that investors agree to buy is termed subscribed capital. This shows the level of interest investors have in the company’s shares.

9. Paid-up Capital

This refers to the actual amount paid by the shareholders for the subscribed shares. It is the amount the company has received and can use for its operations. Paid-up capital can never exceed subscribed capital.

Understanding these terms is crucial when evaluating a company’s equity structure. Equity capital is a significant component of a company’s financial structure, as it includes shareholder equity and retained earnings, which can surpass the contributed equity capital from stockholders over time.

Equity Share Capital Explained

What is Equity Share Capital?

Equity share capital is the total amount raised by a company through the issuance of equity shares. It forms the base of the company’s financial structure and determines the level of ownership for each shareholder. Additional paid-in capital plays a crucial role in the overall valuation of a company by contributing to the total shareholders’ equity figures. Equity capital is significant in the company’s financial structure as it includes both the contributed equity capital from stockholders and retained earnings, which can surpass the initial contributions over time.

Importance of Equity Share Capital

Ownership and Control:

Equity share capital determines the distribution of voting rights among shareholders. The higher the shareholding, the greater the influence an investor has over key business decisions, including board elections, mergers, and other strategic matters. Equity share capital also reflects the company’s assets and financial health, indicating how well the company manages its resources to generate profits and maintain stability.

Dividend Distribution:

Profits are distributed to equity shareholders in proportion to their holdings. The size of the equity share capital often influences the dividend policy of the company and its ability to consistently reward shareholders.

Financial Health:

Investors often view a company with a solid equity share capital base as financially stable. It reflects the confidence of investors in the business and enhances the firm’s credibility with lenders, suppliers, and potential partners. It also shows the company’s capacity to raise funds without increasing its debt burden.

Who are Equity Shareholders?

Equity shareholders enjoy several essential rights that reflect their ownership and ensure their active participation in a company’s affairs. Owning equity signifies an ownership stake in a company, aligning the interests of equity holders with the business’s success, and equity investors play a crucial role by purchasing shares to gain ownership, expecting to profit through dividends or capital gains:

- Voting Rights on Key Decisions: Equity shareholders have the right to vote on crucial matters such as mergers, acquisitions, changes in company policies, and the appointment or removal of board members. This gives them significant influence over the company’s strategic direction.

- Right to Dividends: Equity shareholders receive a portion of the company’s profits as dividends, although the company determines the amount and frequency based on its performance and dividend policy.

- Right to Residual Assets During Liquidation: In the unfortunate event of company liquidation, equity shareholders can claim the residual assets only after the company settles all debts and liabilities, including payments to preference shareholders and creditors.

- Access to Annual Reports and Meetings: Shareholders attend annual general meetings (AGMs), receive financial statements, and stay informed about the company’s performance. This access allows them to evaluate the management’s decisions and raise concerns if necessary.

These rights collectively reinforce the position of equity shareholders as key stakeholders in a company’s present and future.

Benefits of Investing in Equity Shares

- Capital Appreciation: Equity shares have the potential to grow significantly in value over time, providing investors with capital gains when they sell their holdings at a higher price than the purchase cost. The current market value plays a crucial role in determining the worth of equity shares, as it reflects the price at which investors can sell them in the market. Additionally, net asset value plays a significant role in evaluating equity investments by accounting for the value of assets after liabilities.

- Dividends: Many companies share a portion of their profits with shareholders in the form of dividends. These provide a steady income stream, especially from companies with a consistent profit record.

- Ownership Rights: Equity shareholders are partial owners of the company. They enjoy voting rights and can influence key decisions, offering a sense of control and involvement in the business.

- Liquidity: Equity shares are listed on stock exchanges, making them easily tradable. Investors can quickly buy or sell their shares during trading hours, offering flexibility and access to funds.

Risks of Equity Investment and Current Market Value

- Market Risk: The value of equity shares fluctuates based on market conditions, economic factors, and investor sentiment. Subtracting liabilities is crucial in determining the net position of equity investments. Ownership interest represents the value shareholders hold after deducting liabilities, highlighting its significance for equity shareholders. This can lead to temporary or prolonged declines in stock prices.

- Business Risk: Company-specific issues such as poor management decisions, declining sales, or regulatory penalties can adversely impact the share price, regardless of broader market performance.

- Dividend Uncertainty: Unlike fixed-income investments, dividends from equity shares are not guaranteed. A company may decide to retain earnings instead of paying dividends, depending on financial needs.

- Dilution of Ownership: If a company issues additional shares, the ownership percentage of existing shareholders may decrease, potentially affecting control and per-share earnings.

Open free demat account in 5 minutes

Conclusion:

Understanding equity, its types, and particularly equity shares can help you build a strong investment strategy. Whether you aim for dividends, growth, or control, each type of equity offers unique benefits.

Grasping the differences between equity and preference shares, analysing share capital, and knowing shareholder rights is key to making informed decisions.

At Jainam Broking Ltd., we provide expert research, personalised guidance, and digital tools to help you navigate equity investments confidently and align them with your financial goals.

So, are you planning on trading in the stock market? If yes, you are at the right place!

Open a Demat Account with Jainam Broking Ltd. Now!

[ad_2]

publish_date]