[ad_1]

Introduction

Corporate actions play a crucial role in shaping a company’s financial and operational structure. These actions, taken by publicly traded companies, directly impact shareholders and investors by influencing stock prices, ownership structure, and overall market perception. Corporate actions can range from dividends and stock splits to mergers and acquisitions, each with its implications for market participants.

For investors, understanding corporate actions is essential as they determine eligibility for benefits such as dividends, rights issues, or share buybacks. Being well-informed about these actions helps investors strategise their portfolios effectively, minimising risks and maximising returns. Furthermore, tracking corporate actions allows investors to anticipate potential market movements, ensuring they make informed investment decisions.

Corporate Actions and Their Types

Corporate actions can be classified into three main categories:

1. Mandatory Corporate Actions

Mandatory corporate actions require no input from shareholders and are executed automatically by the company. Examples include:

- Dividends (Corporate Actions Dividends) – Companies distribute profits to shareholders in the form of cash or stock dividends.

- Bonus Issues – Additional shares are issued to existing shareholders without any cost.

- Stock Splits – The number of shares increases, reducing the price per share while maintaining the overall value.

2. Voluntary Corporate Actions

Voluntary corporate actions require shareholders to participate actively. Some common voluntary actions include:

- Rights Issue (Corporate Actions Rights Issue) – Companies offer existing shareholders the opportunity to purchase additional shares at a discounted price.

- Buybacks – The company repurchases its shares from investors to reduce the total number of outstanding shares and improve earnings per share.

3. Mandatory with Options

In these corporate actions, shareholders have the option to choose between different benefits. An example is a dividend payout where investors can opt for cash or stock dividends.

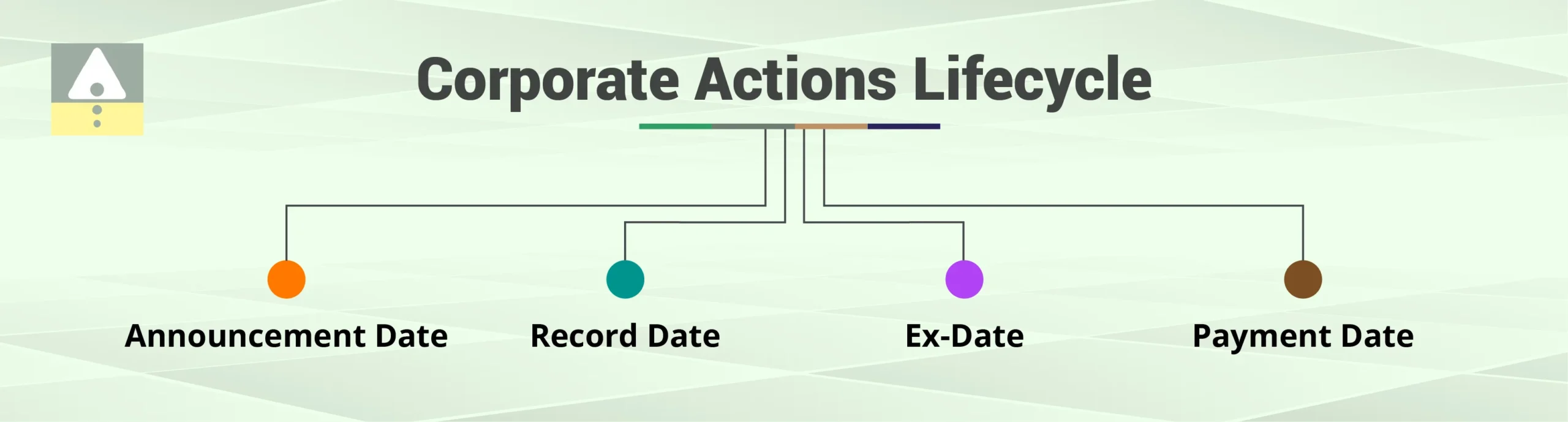

Corporate Actions Lifecycle

Every corporate action’s lifecycle has a structure, including key dates that investors must track. The corporate actions dates help determine eligibility and impact on holdings. The lifecycle includes:

- Announcement Date – The company officially declares the corporate action, providing details about its nature, impact, and key dates. This is the first public disclosure, allowing investors to prepare for potential changes in stock value or ownership structure.

- Record Date – This date determines which shareholders are eligible for the corporate action. Only those who own shares on this date will benefit from the event. Investors who purchase shares after this date will not be entitled to the benefits of the corporate action.

- Ex-Date – This is the cutoff date after which new buyers of the stock are not entitled to the benefits of the corporate action. The stock price may adjust on this date to reflect the impact of the corporate action, ensuring that buyers after this date do not receive benefits they are not entitled to.

- Payment Date – The final stage, where the benefits, such as dividends, bonus shares, or rights issues, are distributed to eligible shareholders. This date is critical as it marks when investors receive the financial or stock-based benefits of the corporate action.

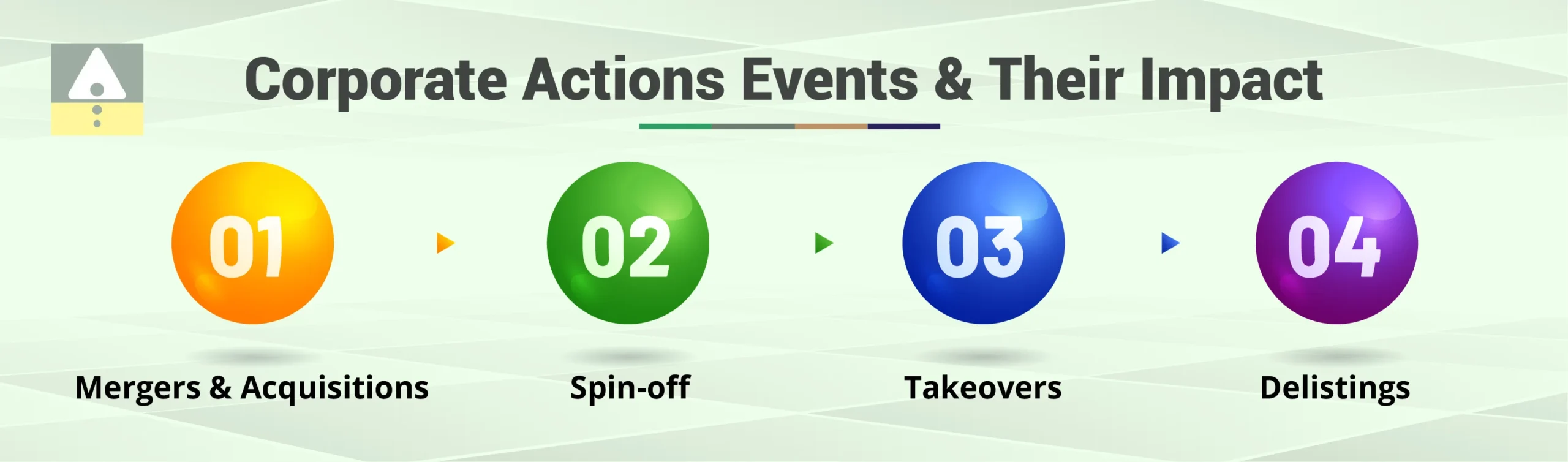

Corporate Actions, Events, and Their Impact

Corporate actions events, such as mergers, acquisitions, spin-offs, and takeovers, can significantly influence stock prices and investor sentiment. For instance:

- Mergers & Acquisitions – When two companies merge or one acquires another, the stock valuations of both entities are affected. Investors holding shares in either company may receive new shares, cash, or a combination of both, depending on the terms of the deal.

- Spin-offs – In a spin-off, a company separates a division or subsidiary into an independent entity. Existing shareholders typically receive shares in the newly created company. This can provide new investment opportunities while altering the valuation of the parent company.

- Takeovers – When a company acquires another, it may offer cash or stock to the target company’s shareholders. Depending on whether the takeover is friendly or hostile, the stock price of both companies may experience volatility.

- Delistings – A company can be removed from stock exchanges for various reasons, such as mergers, financial instability, or voluntary delisting

How do Corporate Actions Affect Corporate Stock?

Investors must evaluate how corporate actions influence corporate stock performance. Some actions, like dividend payments, signal financial health, while others, like stock splits, increase liquidity but do not alter overall valuation.

Corporate Actions List and Tracking

Corporate actions are events initiated by a company that can affect its stock price, shareholders, or both. These actions are crucial for investors because they can impact an investment’s value and lead to changes in the way shares are held or traded. Staying updated with corporate actions is an essential part of active investing, as it allows investors to make informed decisions.

Key Corporate Actions

Dividends:

A company may declare a dividend as a distribution of its profits to shareholders. Investors who hold shares on the “record date” are eligible to receive dividends. Tracking dividend announcements is essential for income-focused investors.

Stock Splits:

A company may issue additional shares to shareholders in proportion to their current holdings, which results in a reduction in the share price. A 2-for-1 stock split, for instance, would double the number of shares an investor holds but halve the stock price.

Bonus Shares:

Bonus shares are additional shares given to existing shareholders for free, based on the number of shares they already own. They are typically issued when a company has accumulated profits and wants to distribute them to shareholders without paying cash.

Rights Issues:

Companies may offer existing shareholders the right to purchase additional shares at a discounted price, usually to raise capital. Tracking rights issues is important for investors to understand whether they need to buy additional shares to maintain their proportional ownership in the company.

Mergers and Acquisitions (M&A):

A merger or acquisition can significantly affect the company’s stock price and shareholders. It’s important to track these events as they can result in changes to a company’s ownership, structure, and value.

Delisting:

A company may voluntarily or involuntarily delist its stock from a stock exchange. This could be due to a merger, buyout, or financial issues. For investors, this could lead to a loss of liquidity and potential changes in the market value of their shares.

Spin-offs:

A company may decide to spin off part of its business into a new, independent company. Shareholders often receive shares in the new company proportional to their holdings in the parent company.

Share Buybacks:

In a buyback, a company repurchases its shares from the market, often to improve stock prices or reduce the number of outstanding shares. This can increase the value of remaining shares and is usually seen as a positive sign by investors.

Corporate Action Tracking on BSE and NSE

Major stock exchanges like the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) provide real-time updates on corporate actions. These actions are important for investors to track as they can significantly impact stock prices and shareholder wealth. Both exchanges have dedicated sections for corporate action:

- BSE Corporate Actions: The BSE has a comprehensive list of corporate actions available on their website. Investors can filter corporate actions based on date, company name, or type of action. The platform provides details about dividends, rights issues, splits, bonus issues, etc., which are crucial for stock traders and investors to stay ahead in the market.

- NSE Corporate Actions: The NSE also offers a similar platform for investors to track corporate actions related to companies listed on its exchange. The information provided helps investors assess whether a particular corporate event could impact their investment decisions.

BSEIndia Corporate Action Reports

The BSEIndia Corporate Action Reports provide a detailed and structured report of all corporate actions happening across companies listed on the BSE. These reports typically include:

- Dividend Announcements: The dates for declaring and paying dividends, including the record date and ex-dividend date.

- Rights & Bonus Issues: Information on rights issues, the price at which new shares will be issued, and the rights ratio. Bonus issues are also reported with details on the number of new shares issued to existing shareholders.

- Stock Splits & Mergers: Information on when stock splits or mergers will take place, the impact on shareholders, and the expected price adjustments.

- Public Offers & Buybacks: A list of companies that are repurchasing their shares or offering them in public offerings, with details on the offer price and terms.

The BSE Corporate Action Reports can be crucial for tracking how these events will affect stock prices and for making decisions about buying, selling, or holding stocks based on the announced corporate actions.

BSEIndia Corporate Action Reports

The BSEIndia Corporate Action Reports provide a detailed and structured report of all corporate actions happening across companies listed on the BSE. These reports typically include:

- Dividend Announcements: The dates for declaring and paying dividends, including the record date and ex-dividend date.

- Rights & Bonus Issues: Information on rights issues, the price at which new shares will be issued, and the rights ratio. Bonus issues are also reported with details on the number of new shares issued to existing shareholders.

- Stock Splits & Mergers: Information on when stock splits or mergers will take place, the impact on shareholders, and the expected price adjustments.

- Public Offers & Buybacks: A list of companies that are repurchasing their shares or offering them in public offerings, with details on the offer price and terms.

The BSE Corporate Action Reports can be crucial for tracking how these events will affect stock prices and for making decisions about buying, selling, or holding stocks based on the announced corporate actions.

Importance for Investors

- Informed Decision-Making: By staying updated on corporate actions, investors can make informed decisions. For example, they might decide to buy additional shares during a rights issue or sell off holdings in response to a stock split or merger.

- Tax Planning: Corporate actions like dividends and bonus issues can have tax implications, so investors need to track these events to plan accordingly. Dividends may be subject to taxation, while stock splits or bonus shares might not have immediate tax consequences but could affect future capital gains.

- Market Impact: Corporate actions often lead to stock price volatility. For example, a company announcing a stock buyback program might see an increase in its stock price, while a merger could result in significant price movements. Tracking these events helps investors anticipate market reactions.

- Portfolio Management: Investors often need to adjust their portfolios based on corporate actions. For example, when a company announces a stock split, investors may need to rebalance their holdings, and if there is a merger or acquisition, they may need to evaluate the new structure of the company.

Open free demat account in 5 minutes

Conclusion

Understanding corporate action helps investors anticipate market movements and optimise their portfolios. Regularly monitoring corporate action events and key corporate action dates ensures that investors make informed financial decisions. Whether investing in corporate stock or tracking corporate actions dividends, being aware of these factors is essential for navigating the stock market effectively.

For expert guidance on corporate actions and investment strategies, consider Jainam Broking as your trusted financial partner.

So, are you planning on trading in the stock market? If yes, you are at the right place!

Open a Free Demat Account with Jainam Broking Ltd. Now!

[ad_2]

publish_date]