Introduction

Dividends, including interim dividend, play a significant role in an investor’s overall return on investment in equity markets. They represent a company’s way of sharing its profits with shareholders, providing them with periodic income in addition to capital appreciation. Companies distribute dividends to reward investors for their trust and participation in the company’s growth.

Dividends are broadly classified into two types: interim dividend and final dividend. An interim dividend is paid before the completion of a company’s financial year, often based on estimated profits, while a final dividend is declared at the end of the financial year after reviewing audited financial statements. Each type of dividend has distinct characteristics, approval processes, and implications on a company’s financials.

For investors, understanding the difference between interim dividend vs final dividend is essential to making informed investment decisions, especially when evaluating dividend stocks. Companies with consistent dividend payouts are often seen as financially stable, making them attractive to long-term investors seeking passive income.

In this article, we will explore the key differences between interim and final dividends, their impact on financial statements such as the cash flow statement and balance sheet, and how dividend-paying stocks can enhance an investment portfolio. We will also discuss crucial dividend-related dates like the ex-dividend date and record date, which influence an investor’s eligibility to receive dividends.

What is an Interim Dividend?

An interim dividend is a dividend declared and paid by a company before the end of the financial year. Unlike the final dividend, which is recommended by the board of directors and approved by shareholders at the Annual General Meeting (AGM), an interim dividend is declared at the discretion of the board of directors and does not require shareholder approval.

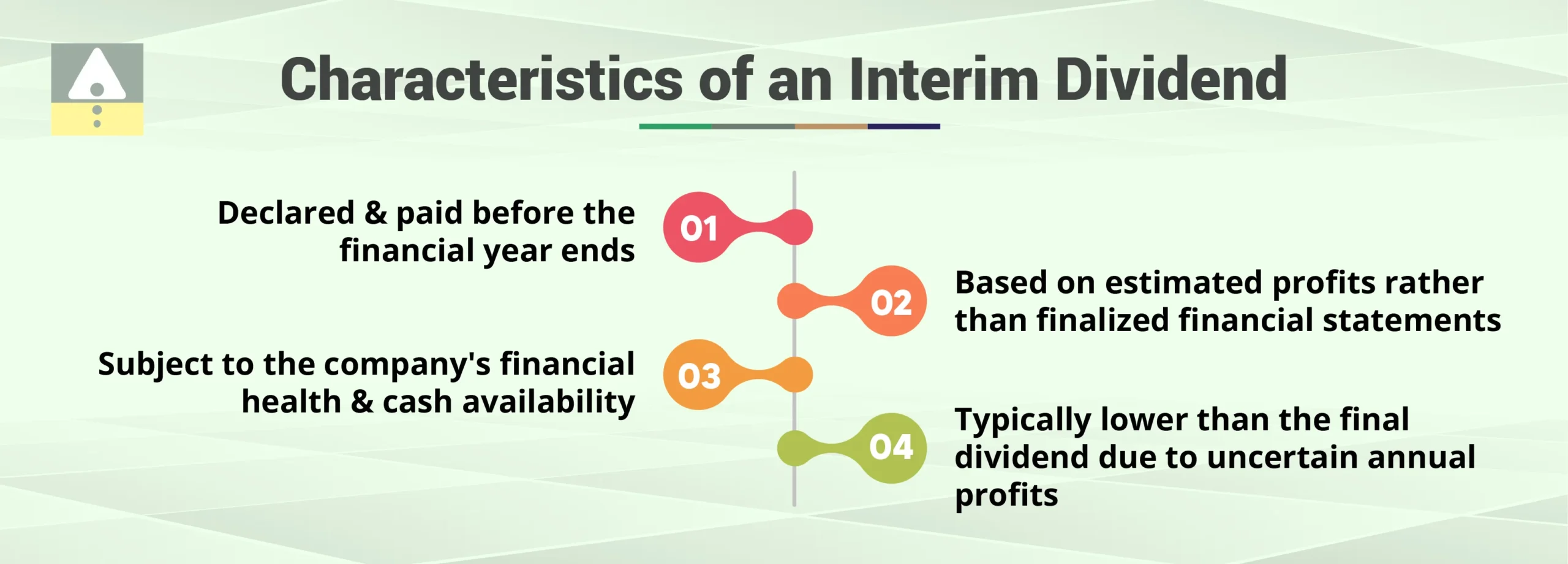

Characteristics of an Interim Dividend

- Declared and paid before the financial year ends: An interim dividend is announced within the financial year, usually after reviewing the company’s interim financial performance. It provides an early return to shareholders without waiting for year-end financial results.

- Based on estimated profits rather than finalized financial statements: Since an interim dividend is declared before the annual financials are finalized, it is based on projected earnings and expected profitability rather than audited results. Companies typically rely on half-yearly or quarterly financial performance to justify interim dividend payouts.

- Subject to the company’s financial health and cash availability: A company must assess its cash reserves, ongoing operational expenses, and future financial obligations before deciding to issue an interim dividend. Unlike a final dividend, which is based on actual profits, an interim dividend requires careful liquidity management to ensure the company remains financially stable.

- Typically lower than the final dividend due to uncertain annual profits: Since the full-year earnings are not confirmed, companies tend to be conservative in setting interim dividend amounts. The final dividend, which accounts for the total profitability of the year, is usually higher if the company meets or exceeds expected earnings.

Interim Dividend in Cash Flow Statement

When a company pays an interim dividend, it affects the cash flow statement under the financing activities section. Dividend payments represent cash outflows, directly impacting the company’s liquidity and cash reserves. The key implications are:

- Reduction in Cash Reserves: Since dividends are paid out in cash, the company experiences a decline in available funds, which could impact short-term financial flexibility.

- Recorded as a Financing Activity: In the cash flow statement, the interim dividend payment appears under financing activities, similar to other shareholder distributions like share buybacks.

- Effect on Liquidity: If a company pays an interim dividend without maintaining adequate reserves, it could strain liquidity, limiting its ability to invest in expansion or meet operational expenses.

- Investor Perception: Regular and consistent interim dividend payments can be seen as a positive indicator of a company’s financial stability and commitment to rewarding shareholders.

Interim Dividend in Balance Sheet

From a balance sheet perspective, an interim dividend reduces retained earnings and cash balances. The main effects include:

- Deduction from Retained Earnings: An interim dividend is subtracted from retained earnings, reducing the total reserves available for reinvestment in the business.

- Reduction in Cash and Bank Balances: Since dividends are paid out in cash, the company’s cash and cash equivalents decrease accordingly.

- Impact on Net Worth: The total shareholders’ equity declines as profits that could have been retained are distributed instead.

- Liability Until Paid: Once declared but not yet paid, the interim dividend appears as a current liability in the balance sheet, reflecting the company’s obligation to its shareholders.

Interim Dividend Paid: How it Works

The process of paying an interim dividend involves the following steps:

- Board Approval: The board of directors reviews the company’s financial status before declaring an interim dividend. They analyze cash flows, profit margins, and financial projections to ensure the company can afford to pay the dividend without affecting operations.

- Dividend Declaration: Once approved, the company makes a public announcement specifying the dividend amount, payment date, and eligibility criteria. This provides transparency to shareholders and allows investors to plan their investments accordingly.

- Ex Dividend Date: This is the date on which a stock begins trading without the value of the next dividend payment. Investors who purchase shares on or after this date will not receive the interim dividend. Only shareholders who own the stock before the ex dividend date qualify for the payout.

- Record Date: This is the date when the company records the names of shareholders eligible for the dividend. Shareholders must be on the company’s books as of this date to receive the dividend.

- Dividend Payment: The company credits the interim dividend to shareholders on the specified payment date. This may be done through direct bank transfers or dividend warrants, depending on the shareholder’s registered payment method.

What is a Final Dividend?

A final dividend is the dividend declared at the end of the financial year based on the company’s audited financial performance. It is recommended by the board and approved by shareholders at the AGM.

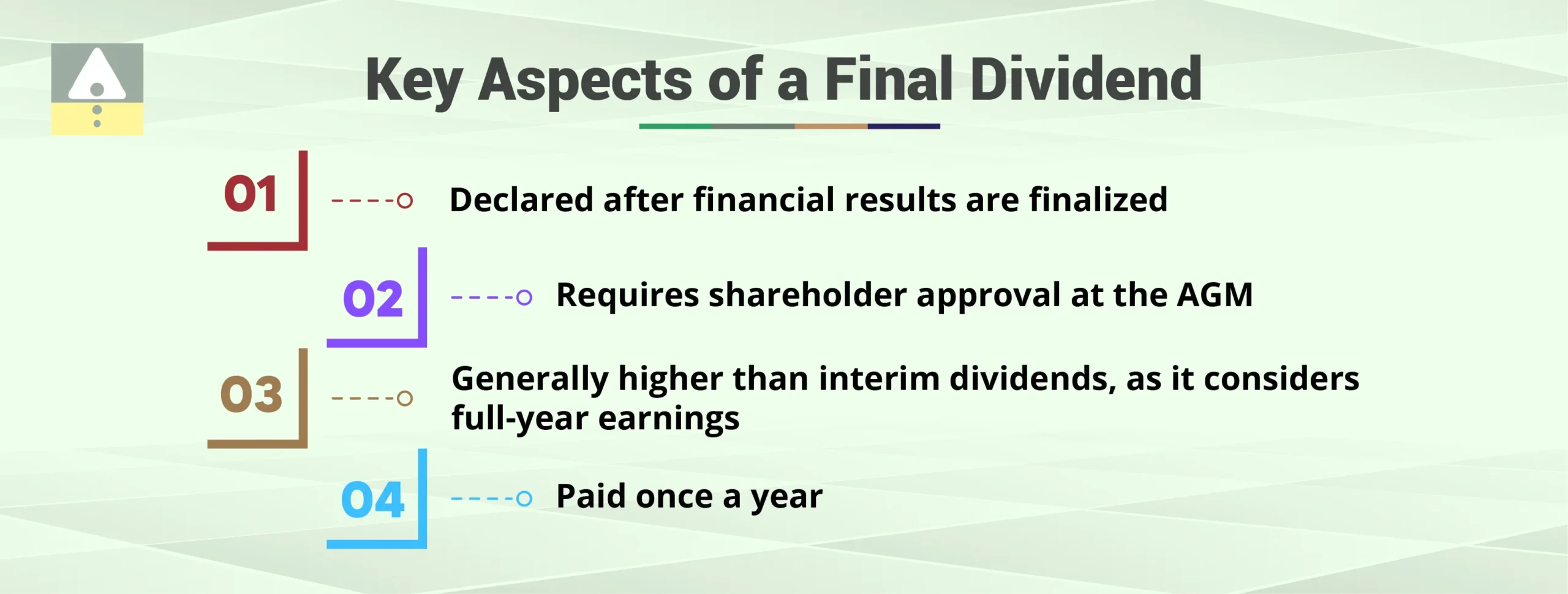

Key Aspects of a Final Dividend

- Declared after financial results are finalized: Since the final dividend is announced after the financial year ends, it is based on the company’s actual financial performance rather than projections. This makes it a more reliable indicator of the company’s profitability.

- Requires shareholder approval at the AGM: Unlike an interim dividend, which is approved solely by the board of directors, a final dividend requires approval from shareholders during the Annual General Meeting (AGM). This ensures transparency and shareholder involvement in the decision-making process.

- Generally higher than interim dividends, as it considers full-year earnings: Since the final dividend is determined after the company has a clear picture of its annual earnings, it tends to be larger than the interim dividend. The final dividend reflects the company’s full-year profitability and ability to return capital to shareholders.

- Paid once a year: A final dividend is declared and distributed once a year, usually after the company’s financial statements are audited and approved. This single payout ensures that all financial aspects, including net income and retained earnings, are considered before distributing funds to shareholders.

Comparison: Interim Dividend vs Final Dividend

| Feature | Interim Dividend | Final Dividend |

| Declaration Time | Before financial year ends | Before the financial year ends |

| Approval | Board of Directors | Shareholders at AGM |

| Basis | Estimated profits | Audited financials |

| Frequency | Multiple times in a year | Once per year |

| Impact on Financials | Deducted from retained earnings immediately | Deducted after AGM approval |

Dividend Stocks and Investment Considerations

Investing in dividend stocks can be a great way to earn passive income. Dividend-paying companies tend to be well-established and financially stable, making them attractive to long-term investors.

How to Identify Good Dividend Stocks?

- Dividend Yield: Measures the annual dividend as a percentage of the stock price.

- Dividend Payout Ratio: Indicates the percentage of earnings paid as dividends.

- Earnings Growth: Sustainable earnings ensure consistent dividend payouts.

- Dividend History: Companies with a track record of regular dividends are more reliable.

- Financial Stability: Strong cash flows and low debt levels indicate a company’s ability to sustain dividends.

Dividend Stocks List

Investors often rely on curated lists of dividend-paying stocks to identify potential investment opportunities. Here are some well-known Indian companies that have consistently rewarded shareholders with dividends:

1. Infosys Ltd

Sector: Information Technology

Market Cap: ₹ 6,60,556 Cr.

About: Infosys Ltd is a leading global provider of consulting, technology, outsourcing, and digital transformation services. It ranks as the second-largest IT company in India, following TCS.

Pros

- Virtually debt-free company.

- Strong return on equity (ROE) with a 3-year average of 30.9%.

- Maintains a robust dividend payout ratio of 63.3%.

2. ITC Ltd

Sector: Conglomerate (FMCG, Hotels, Paperboards, Packaging, Agri-Business, and Information Technology)

Market Cap: ₹ 5,10,734 Cr.

About: Founded in 1910, ITC is India’s largest cigarette manufacturer and operates across multiple segments, including FMCG, hotels, paperboards, packaging, and agri-business.

Pros

- Almost no debt.

- Attractive dividend yield of 3.37%.

- Consistently strong ROE of 27.5% over the last three years.

- High dividend payout ratio of 92.4%.

3. HCL Technologies Ltd

Sector: Information Technology

Market Cap: ₹ 4,19,357 Cr.

About: A global IT services giant, HCL Technologies is among India’s top five IT firms by revenue. Since its IPO in 1999, the company has focused on digital transformation, engineering, R&D, and BPO services, operating across 46 countries.

Pros

- Almost debt-free.

- Solid dividend yield of 3.49%.

- Consistently maintains a high dividend payout of 87.4%.

4. NTPC Ltd

Sector: Power Generation

Market Cap: ₹ 3,21,784 Cr.

About: NTPC (National Thermal Power Corporation) is India’s leading power generation company, supplying bulk electricity to state utilities. The company is also involved in consultancy, project management, energy trading, oil & gas exploration, and coal mining.

Pros

- The company has a Steady dividend payout of 39.5%.

5. Power Grid Corporation of India Ltd

Sector: Power Transmission

Market Cap: ₹ 2,48,698 Cr.

About: Power Grid Corporation of India Limited (PGCIL), a Maharatna PSU, is India’s largest power transmission company. The Government of India holds a 51.34% stake in the firm. PGCIL is responsible for interstate power transmission, telecom services, and consultancy projects, often executing strategic assignments from the government.

Pros

- Attractive dividend yield of 4.21%.

- Healthy dividend payout ratio of 65.0%. 65.0%

Key Dates in Dividend Investing

Dividend investors must pay attention to specific dates to ensure they receive their entitled dividends. The most important dates include:

Upcoming Dividend Announcements

Companies periodically announce their upcoming dividend schedules, informing investors about dividend declarations, record dates, and payment dates. These announcements help investors make informed decisions and can influence stock prices. A strong dividend history often indicates a financially sound company, attracting long-term investors.

Ex-Dividend Date

The ex dividend date is a critical cutoff date that determines dividend eligibility. If an investor purchases shares on or after the ex dividend date, they will not receive the declared dividend. Only shareholders who own the stock before this date qualify for the payout.

Key considerations about the ex dividend date:

- Stock Price Adjustment: On the ex dividend date, the stock price typically adjusts downward by the dividend amount, reflecting the reduction in company equity.

- Trading Strategy: Investors looking to earn dividends must ensure they buy shares at least one day before the ex dividend date.

- Short-Term vs Long-Term Impact: Some investors buy shares before the ex dividend date and sell them immediately after receiving the dividend, a strategy known as dividend capture trading. However, others prefer a long term dividend reinvestment approach.

What is Ex Date for Dividend?

The ex date for a dividend is crucial for investors as it determines dividend eligibility. If an investor wants to earn the upcoming dividend, they must purchase the stock before the ex date.

For example:

- Company ABC announces a dividend with an ex dividend date of March 10.

- Investors must buy shares before March 9 to receive the dividend.

- If bought on March 10 or later, they will not receive the dividend.

Open free demat account in 5 minutes

Conclusion

Understanding interim dividend vs final dividend helps investors make informed decisions about dividend stocks. While an interim dividend provides periodic returns, a final dividend represents the company’s full-year profitability. Both impact a company’s financials differently and have distinct approval processes.

By tracking upcoming dividends, monitoring ex-dividend dates, and evaluating dividend stock lists, investors can strategically plan their investments for steady income generation. Whether you prefer interim payouts for consistent cash flow or final dividends for a lump sum, dividends remain a key factor in wealth-building strategies.

Jainam Broking Ltd. helps investors navigate dividend investing by providing expert insights, research, and investment recommendations. With a strong focus on financial education and market expertise.

So, are you planning on trading in the stock market? If yes, you are at the right place!

Open a Demat Account with Jainam Broking Ltd. Now!

publish_date]