[ad_1]

Introduction

Participating in an Initial Public Offer (IPO) allows investors to become shareholders in a company before it is listed on the stock exchange. However, despite applying, many investors experience disappointment due to the non-allotment of shares. T

The IPO allotment process follows specific regulations, and multiple factors can contribute to an investor not receiving shares.

This blog explores the common reasons behind the non-allotment of shares in IPO and provides insights on how to improve your chances of getting an allotment.

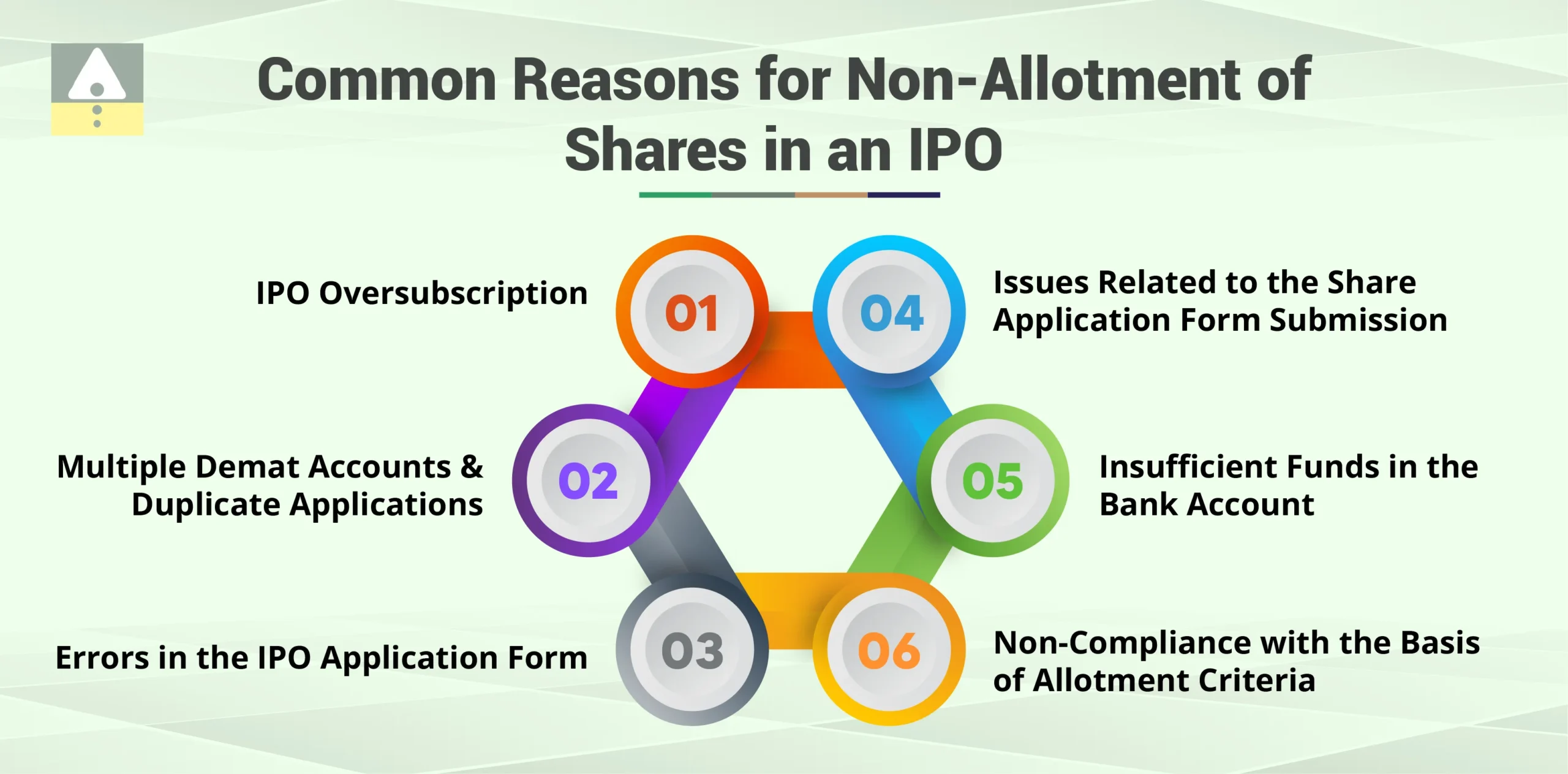

Common Reasons for Non-Allotment of Shares in IPO

IPO Oversubscription

One of the primary reasons for non-allotment is IPO oversubscription. When an IPO receives applications exceeding the available shares, the allotment is done through a lottery system for retail investors. In case of extreme oversubscription, the chances of allotment decrease significantly.

Multiple Demat Accounts and Duplicate Applications

Applying for an IPO using multiple Demat accounts linked to the same PAN is against the rules. If an investor submits multiple applications using different Demat accounts but the same PAN, all applications are likely to be rejected.

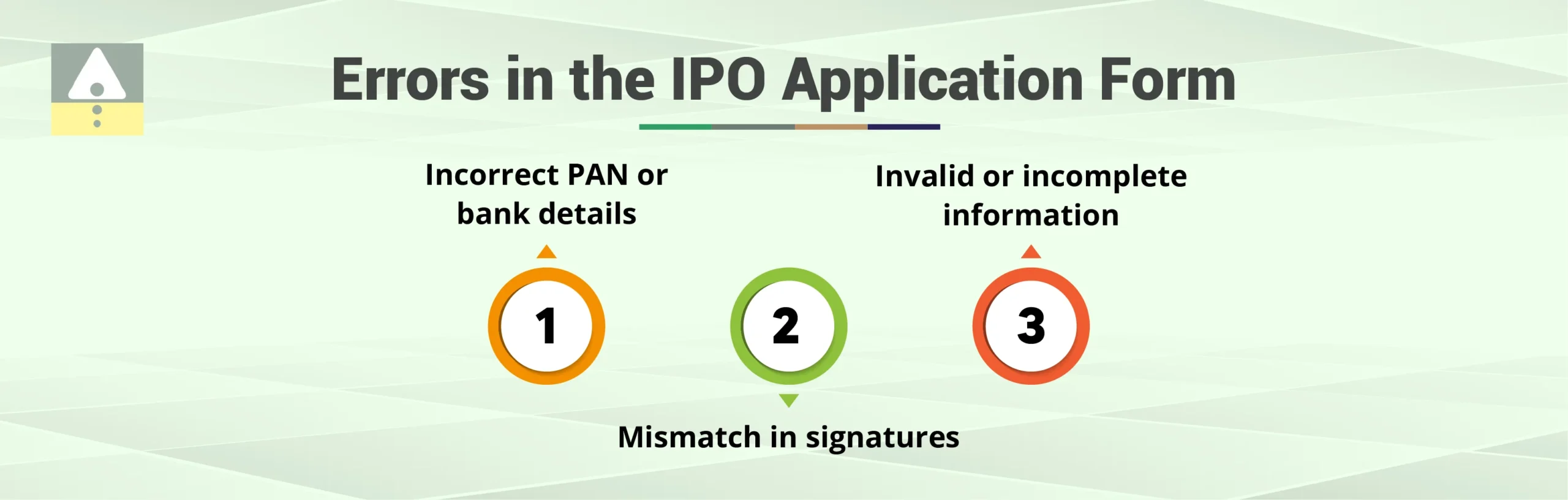

Errors in the IPO Application Form

Mistakes in filling out the IPO application form can lead to rejection. Common errors include:

- Incorrect PAN or bank details

- Mismatch in signatures

- Invalid or incomplete information

Issues Related to the Share Application Form Submission

Submitting an incorrect or incomplete share application form can also lead to rejection. Investors should ensure that the form is filled out correctly and submitted within the deadline.

Any missing information, such as PAN details, bank details, or the applicant’s name, can result in disqualification. Additionally, errors in signatures or discrepancies between the details provided in the form and those registered with the Depository Participant (DP) may also lead to rejection.

Investors should double-check all details before submission and ensure that the form is submitted well before the deadline to avoid last-minute technical glitches or processing delays. Using the Application Supported by Blocked Amount (ASBA) facility correctly can also help in ensuring a smooth application process.

Insufficient Funds in the Bank Account

An IPO application is only valid if sufficient funds are in the linked bank account at the time of blocking. If the required funds are not available, the application is rejected automatically.

The ASBA process instructs banks to block the required amount in the investor’s account until the allotment is complete. If the account balance falls below the application amount, the bank will likely decline the request.

Additionally, issues such as incorrect bank details, expired mandates, or delays in fund blocking by the bank can also lead to rejection. Investors should ensure that the bank account linked to the IPO application has a sufficient balance and is active to avoid any unexpected rejections.

Keeping track of account transactions and verifying the fund-blocking status through bank notifications can help prevent such issues.

Non-Compliance with the Basis of Allotment Criteria

The basis of allotment varies depending on the type of investor (retail, institutional, or non-institutional). If an investor does not meet the eligibility criteria set by the issuer, their application may be rejected.

The Role of the Book Building Process in IPO Allotment

Understanding the Book Building IPO

A book-building IPO is a price discovery method where investors bid within a specified price range. The final allotment price is determined based on demand. The company, along with investment bankers, decides on a price band, and investors place bids within this range.

The price at which the maximum demand is observed becomes the final issue price. This dynamic pricing mechanism helps in efficient price discovery and allows companies to gauge investor sentiment.

Investors participating in a book-building IPO should carefully assess the company’s fundamentals, demand trends, and historical performance before bidding. Since the allotment process is demand-driven, bidding wisely within the given price band can significantly impact the likelihood of securing an allotment.

Price Band and Cut-off Price Considerations

The price band in a book-building IPO represents the lower and upper price limits within which investors can bid. Investors who bid below the final determined price risk missing out on the allotment if their bid falls short of the actual issue price.

Conversely, bidding at the cut-off price ensures that the investor agrees to purchase shares at the final issue price, improving the chances of receiving an allotment.

Bidding at a lower price within the price band may reduce the chances of getting an allotment, especially in cases of oversubscription.

Institutional and retail investors who bid at the cut-off price demonstrate their willingness to accept the final price, which can significantly enhance their likelihood of securing shares.

Additionally, investors should carefully analyze the demand trends in different investor categories (such as Qualified Institutional Buyers, Non-Institutional Investors, and Retail Investors) to make informed bidding decisions.

By understanding the dynamics of book building and price band strategies, investors can optimize their IPO bidding approach and increase their chances of getting an allotment.

Submitting a Properly Filled IPO Application Form

Ensuring that the IPO application form is filled out accurately reduces the chances of rejection. Investors should verify all personal and financial details before submitting their applications. Any discrepancy in PAN details, bank account information, or signatures can result in rejection. Double-checking the form and ensuring it is complete with no errors can significantly increase the likelihood of successful allotment.

Applying at the Cut-off Price in a Book Building IPO

Opting for the cut-off price increases the probability of getting an allotment, as it aligns with the final price set by the issuer. Investors who bid at a lower price within the price band may miss out on the allotment if the final issue price is higher than their bid.

To maximize the chances of securing an allotment, it is advisable to always apply at the cut-off price, as it indicates a willingness to purchase at the final price determined by demand.

Ensuring Sufficient Funds in the Linked Bank Account

Maintaining adequate funds in the bank account helps avoid rejection due to insufficient balance. Investors should check their bank balance before applying to ensure that the required amount is available and remains unutilized until the allotment process is complete.

Using the ASBA facility correctly ensures that the amount remains blocked instead of debited, preventing accidental withdrawals that could cause rejection.

Banks may also reject applications with transaction issues, such as expired mandates or inactive accounts. Keeping track of ASBA fund blocking notifications and resolving any banking issues promptly can improve the chances of a successful IPO application.

Avoiding Multiple Applications from the Same PAN

To prevent rejection, investors should apply only once per PAN and avoid duplicate applications. Some investors try to increase their chances of allotment by submitting multiple applications using different Demat accounts linked to the same PAN.

However, as per SEBI regulations, such duplicate applications are automatically rejected. Instead, investors can consider applying through family members’ accounts as long as each application is unique and follows the correct process.

By adhering to these best practices, investors can enhance their chances of successfully receiving shares in an IPO.

Open free demat account in 5 minutes

Conclusion

IPO allotment is a competitive process influenced by oversubscription, investor eligibility, and application accuracy. Understanding the basis of allotment and adhering to guidelines can help improve the chances of securing an allotment.

By following best practices, such as applying at the cut-off price, ensuring fund availability, and avoiding multiple applications, investors can maximize their chances of successfully receiving IPO shares.

At Jainam Broking, we strive to assist investors in making informed decisions and enhancing their IPO investment experience.

So, are you planning to Apply IPO? If yes, you are at the right place!

Open a Demat Account with Jainam Broking Ltd. Now!

[ad_2]

publish_date]